Copper Miners are Hot

By Laurent MAUREL.

A seasoned investor and financial analyst with over 20 years of expertise in the metals and mining sector. As the founder of Recherche Bay, he provides market analysis and investment insights for Family Offices and Private Equity firms. His expertise includes asset valuation, financial due diligence, and portfolio strategy, with accreditation from the AMF.

The global bond market is entering a new phase of tension. In the United Kingdom, Chancellor Rachel Reeves' U-turn on social spending cuts has shaken investor confidence. Thirty-year gilt yields surged by 22 basis points, triggering a sharp drop in the pound and reviving memories of the 2022 gilt crisis. Political uncertainty is now weighing heavily on markets.

Within 24 hours of the spike in 30-year gilt yields, the Bank of England responded with exceptional force. Amid rapidly escalating stress in the UK bond market, the BOE injected £74.2 billion in liquidity through its Short-Term Open Market Operations (ST-OMO)—the highest level ever recorded under this program. This marks an unprecedented emergency intervention not seen since the pension fund crisis of 2022.

This massive support came precisely as 30-year gilt yields were soaring, a signal of a sudden loss of confidence in the UK’s fiscal trajectory. The BOE's intervention appears aimed at halting a panic dynamic in the markets by stabilizing near-term liquidity conditions for financial institutions.

Yet this record-setting injection raises serious questions: is this a one-off move to calm markets, or the beginning of a more systemic support strategy? The simultaneity between the spike in long-term rates and the central bank’s response suggests an acute awareness of the risk of yield curve dislocation—with direct implications for government financing and the portfolio stability of major institutional investors.

Once again, the Bank of England finds itself caught between fiscal pressure, persistent inflation, and nervous markets—forced to choose between monetary credibility and averting a funding crisis.

In Japan, 30-year government bond yields are climbing again, signaling the gradual end of yield curve control. Markets are pricing in a faster pace of monetary tightening, in a context of massive public debt and an aging population.

In the United States, economic conditions are deteriorating. Job losses, declining household incomes and spending (PCE fell 0.1%) point to a marked weakening of domestic demand. The ISM surveys reflect broad-based slowdown, frozen investment, and a climate of strategic uncertainty.

In this environment, the Fed may accelerate rate cuts. However, Treasury Secretary Scott Bessent is pursuing a risky strategy: issuing massive volumes of ultra-short-term T-Bills, while betting on falling rates. This "fiscal QE" is not true quantitative easing, but it produces similar distortions: destabilization of the yield curve, increased speculation, and the risk of asset bubbles.

Analyst Bob Elliott argues that cancelling long-term debt issuance is equivalent to a stealth QE of $4.4 trillion per year—without going through the Fed’s balance sheet. But such a strategy could undermine central bank credibility and force massive interventions to stabilize the T-Bill market.

In this climate of widespread distrust toward fiscal and monetary policy, gold is once again asserting itself as the ultimate safe haven.

Let’s now turn to recent developments in the mining sector, with a particular focus on the turbulent week experienced by the silver market.

Amid extreme volatility, aggressive futures positioning, and an ongoing sector rotation, several key signals deserve closer analysis.

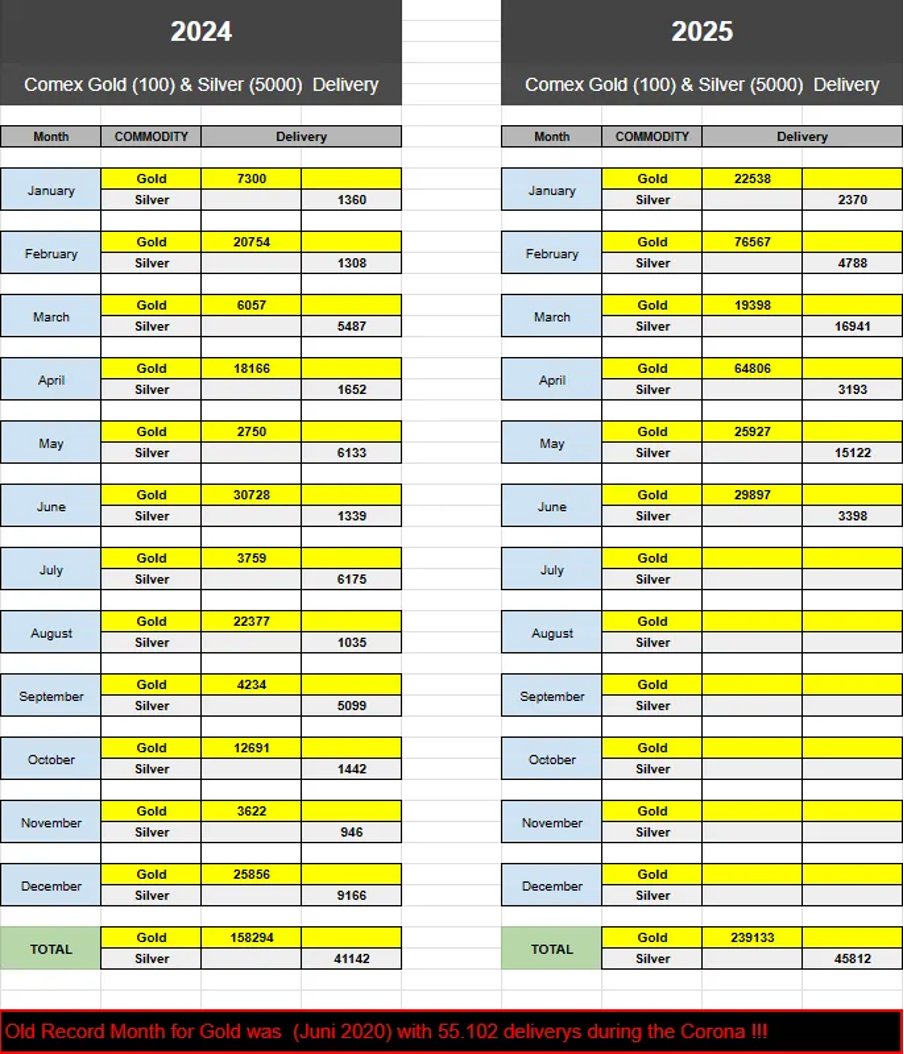

Delivery requests on the COMEX have reached exceptionally high levels, underscoring a structural trend that has been gaining strength month after month since the beginning of the year.

In July 2025 alone, 6,109 contracts have already been declared for delivery—representing 30.5 million ounces of silver, or nearly 950 metric tons of physical metal. This figure marks a 12.8% increase in just two days and stands just below the total recorded for the entire month of July 2024—despite the fact that we are still at the very beginning of the delivery period.

Historically, the bulk of COMEX deliveries takes place in the first days of the month, and July is traditionally a major delivery month for silver contracts. This volume delivered in such a short span is particularly noteworthy. For context, cumulative deliveries since the start of 2025 already far exceed those of 2024 at the same point, reflecting a renewed and accelerating interest in taking physical possession of silver.

Meanwhile, open interest remains just under 7,000 contracts, suggesting the potential for a further wave of deliveries in the coming days. Should a significant portion of these contracts also be exercised, July 2025 could set a new annual record for physical silver deliveries.

This development reflects a deeper structural trend: in a context of growing mistrust toward derivatives markets and persistent inflationary pressures, demand for “delivered” silver—that is, physically held metal—is steadily rising.

This highly strained environment on the COMEX likely explains the intensifying battle around the symbolic $37 per ounce level. This technical threshold has become a flashpoint, where several explosive dynamics are converging.

On one hand, the volume of silver still awaiting delivery remains unusually high, far above the seasonal average. This points to a rising preference among investors for physical settlement rather than mere paper exposure.

On the other hand, the futures market is saturated with short positions, with the number of bearish contracts hovering near all-time highs. This means many market participants are betting on a short-term price decline. Yet this strategy is growing increasingly risky under current conditions.

Indeed, each new short position appears to trigger further demand for physical delivery. In other words, the more short sellers try to push prices down, the more they inadvertently stoke mistrust—prompting some buyers to demand actual metal, which in turn places more strain on COMEX inventories.

This feedback loop is generating extreme stress: the paper market is trying to suppress prices, but the physical market is drying up. If this imbalance continues, the $37 level could become the scene of a full-blown showdown between paper liquidity and real-world scarcity.

Let’s continue this update with a look at the recent performance of my Copper Portfolio.

Since my March bulletin, several copper-focused stocks have surged.

The rest of this article is reserved for signed-in users.

Sign in or create your free account to read the full article.

Comments (0)

Sign in or create a free account to leave a comment.