Manganese 101

By Gaia Research Team.

The Gaia Research Team specializes in sustainable mining investments, focusing on responsible resource extraction. Committed to transparency and innovation, the Team aims to transform the mining sector into a more sustainable industry that benefits both the economy and the planet while addressing the huge supply and demand gap for critical minerals.

Manganese, the rising star of the battery component, is rapidly gaining prominence due to its essential role in various industries, particularly in steel production and electric vehicle (EV) batteries. This versatile transition metal, known for its strength and resistance to wear, is crucial in creating high-performance alloys and cathode materials for lithium-ion batteries. With significant reserves concentrated in countries like South Africa, Gabon, and Australia, manganese production is poised for growth, driven by increasing global demand in the booming EV market and the recovery of the construction sector. This article delves into the properties, applications, supply and demand dynamics, and market trends of manganese, highlighting its significance in the contemporary industrial landscape.

What is manganese?

Manganese properties

Manganese is a hard, brittle, silvery metal, often found in minerals in combination with iron. Manganese is difficult to fuse, but easy to oxidise.

Manganese was first isolated in the 1770s. It is a transition metal with a multifaceted array of industrial alloy uses, particularly in stainless steel. It improves strength, workability, and resistance to wear. Manganese oxide is used as an oxidising agent; as a rubber additive; and in glass making, fertilisers, and ceramics. Manganese sulphate can be used as a fungicide. Manganese is also an essential human dietary element, important in macronutrient metabolism, bone formation, and free radical defense systems.

A relatively abundant metal, manganese is widely distributed throughout Earth’s crust. In addition to terrestrial sources, manganese is present in nodules that are distributed widely over the seafloor. Higher-grade nodules contain 10 % to 20 % manganese along with significant amounts of cobalt, copper, and nickel.

The most common mineral among manganese-containing compounds is pyrolusite, which is manganese dioxide (MnO2). The minerals hausmannite (Mn3O4) and braunite (Mn2O3) are also of great importance.

By the early 21st century, manganese production had expanded to several locations throughout the world. Australia, South Africa, China, Gabon, and India became the largest producers.

Manganese applications

Metallurgical industry

The main use of manganese (up to 90%) is in the metallurgical industry, mainly in producing alloy steels, manganese is used as an alloying component.

Adding just 1% manganese to steel transforms it into stainless steel, significantly enhancing its properties. Manganese steel, which can contain up to 15% manganese, is renowned for its exceptional hardness, strength, and wear resistance. Furthermore, manganese improves the weldability of steel by lowering the melting point of oxides, thereby facilitating the welding process. It also enhances the steel’s deformability, enabling the creation of complex shapes and components without the risk of cracking or breaking.

Additionally, a copper/ nickel alloy containing 13% manganese has a high electrical resistance and is “indifferent” to temperature fluctuations.

Manganese alloys with carbon and silicon are also in high demand, forming the basis for products used across various industries, including applications ranging from armour and heavy machinery for excavation and crushing to equipment for the food industry.

EVs industry

Besides its application in the metallurgical industry, manganese has a crucial use in producing the dominant batteries, lithium-ion batteries, of EVs as a key component in cathode materials.

The dominant cathode chemistry in the auto sector is nickel-cobalt-manganese (NCM). NCM batteries use a combination of nickel, manganese, and cobalt in their cathodes. Manganese enhances the thermal stability of cathodes, improving the safety of batteries under high temperatures or stressful conditions. Manganese is relatively abundant and cheaper compared to cobalt and nickel, making it a cost-effective alternative.

Manganese has therefore gained entry into the lithium-ion battery industry, maintaining a space as one of the key components of EVs. Manganese is essential to the growing EV market as it acts as a stabilizer in NCM-structured lithium-ion batteries, ensuring the battery operates efficiently at high temperatures.

Manganese mine types

The mining of manganese ores is usually done in open pits used for near-surface deposits such as sedimentary and lateritic deposits, which is cost-effective and efficient for large-scale deposits. There is also deep underground mining for deep and high-grade deposits, such as hydrothermal or metamorphic ores, which has higher costs and safety concerns compared to open-pit mining. Additionally, marine mining has been developed for extracting manganese nodules from the seabed, but they cannot compete economically with the near-surface deposits and the technical involved is complex due to the challenges of operating in extreme environments e.g., 4,000 and 6,000 meters below sea level.

Manganese ore types and producing processes

Manganese ores are classified into four main types: manganese oxide ore, manganese carbonate ore, ferromanganese ore, and polymetallic composite ore, each requiring distinct processing methods to produce usable concentrates.

Manganese oxide ores, which generally have a high manganese content, undergo simple yet effective processes such as washing, desliming (to remove fine particles), and gravity or magnetic separation. These steps ensure the production of high-grade manganese concentrates with significantly reduced impurities, which are widely used in steelmaking and battery industries.

Manganese carbonate ores, on the other hand, often contain sulphur, necessitating more complex processing. These ores typically undergo flotation to separate valuable minerals, strong magnetic separation to remove impurities, and roasting if they are sulphur-rich. This results in sulphur-free manganese concentrate that can be directly used or further refined for applications such as alloys and chemical production.

Ferromanganese ores, known for their iron-rich composition, are processed through roasting to alter the mineral properties, followed by magnetic separation to isolate the manganese and gravity separation if needed to improve concentrate quality. The end product is a manganese concentrate with iron as a by-product, making it ideal for producing ferromanganese alloys used in the steel industry.

Lastly, polymetallic composite ores, which contain manganese along with other valuable metals like lead, zinc, or silver, require the most sophisticated processing. These ores are subjected to multiple steps, including washing, screening, gravity and magnetic separation, flotation, and in some cases, electrostatic separation. This advanced approach ensures the recovery of not only manganese but also accompanying metals, resulting in multi-metal concentrates valuable for a range of industrial applications.

The processing of manganese ores is highly tailored, with techniques designed to optimize recovery rates, ensure high purity, and meet the specific requirements of various industries such as steel production and battery manufacturing.

Where is manganese from?

Production by country

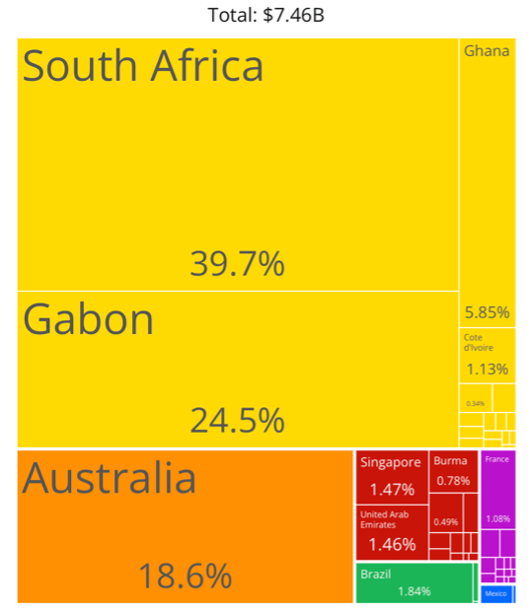

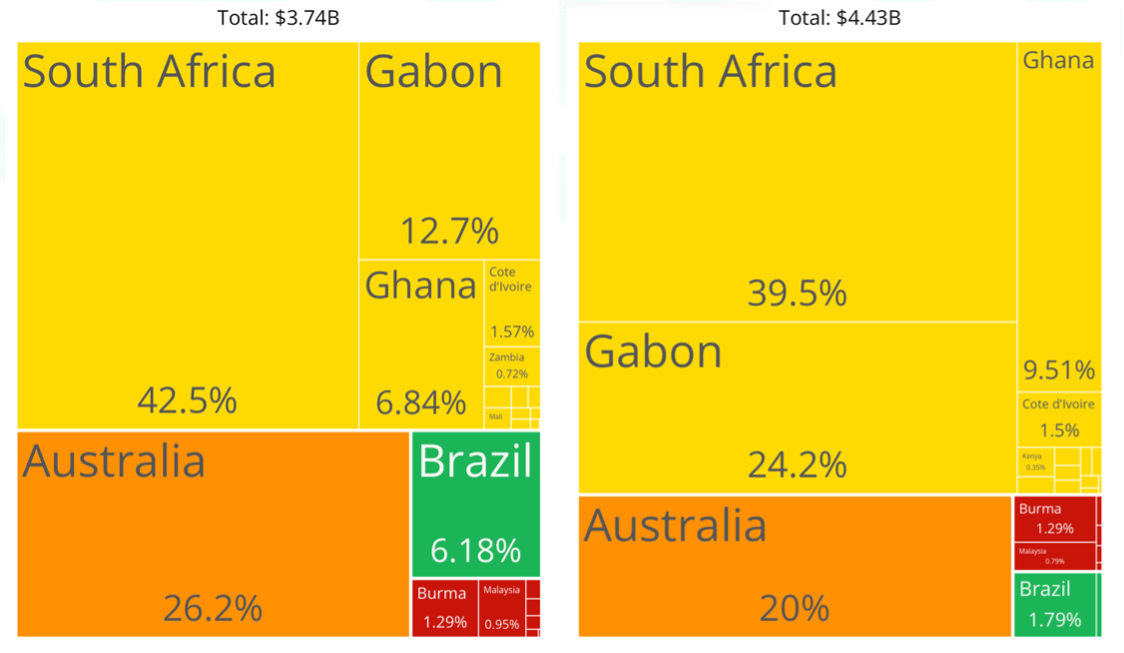

The global manganese supply is primarily sourced from 10 countries, with the top three producers—South Africa, Gabon, and Australia—collectively accounting for 80% of the total global output. Among these, South Africa alone contributes nearly 40% of the world's manganese production, solidifying its position as the dominant supplier.

South Africa as the global leader

With an approximate annual yield of 7.2M metric tons, South Africa is currently the world’s biggest manganese producer in the world. This remarkable output is driven by a combination of key factors, including its vast natural manganese reserves, estimated at 600 Mt, predominantly located in the renowned Kalahari Basin. Complementing its abundant resources, South Africa benefits from a well-developed production infrastructure, further solidifying its position as a global leader in manganese supply.

Although South Africa does export some of its production to support its economy, much of its manganese production is reinvested in the country’s formidable steel production operations.

Gabon ranks as the second-largest manganese-producing country, ahead of Australia, despite possessing only 26% of Australia's manganese reserves, suggesting the significant influence of factors beyond manganese reserves in shaping the final production levels.

Factors impacting manganese production level

In addition to key factors like the presence of natural manganese deposits, there are many other crucial factors.

Gabon’s strategic focus on manganese

Gabon has prioritized manganese as a key export commodity, dedicating significant resources and strategic focus to its development. In contrast, Australia’s mining industry is highly diversified, with greater emphasis on higher-margin resources such as iron ore, gold, and lithium, which may have reduced the focus on manganese production.

Neither Gabon nor Australia possesses a domestic strong steel industry to utilize manganese internally, making exportation critical to the consumption of this resource. China is the major importer for both countries. Gabon’s high-grade manganese ore, its geographical proximity to key markets, and its lower production costs have collectively made Gabonese manganese more favourable for major importers like China.

China has doubled its imports from Gabon in 2022 from 12.7% to 24.2% due to its high-grade ore and lower costs, which can have an impact on the export of Australia-produced manganese, thereby hurting its production in 2023. Chinese companies have also invested directly in Gabonese mining operations, further driving production growth.

High-Grade Manganese Ore

Gabon possesses some of the highest-grade manganese deposits in the world, particularly from the Moanda mine operated by Eramet. Higher-grade ore is more desirable in the market as it requires less processing, making production more cost-effective and competitive.

Proximity to Key Markets

Gabon’s geographical proximity to European and Asian markets provides it with a logistical advantage over Australia, which faces higher shipping costs to reach these markets. Lower transportation costs make Gabonese manganese more competitive, especially in price-sensitive markets.

Cost of Production

Gabon has lower labour and operational costs compared to Australia, where stricter labour laws, higher wages, and environmental regulations increase the cost of production. Gabon’s mining industry benefits from less stringent environmental restrictions, allowing companies to ramp up production more rapidly.

Top manganese suppliers

In 2023, South32 Limited and Eramet were the two largest producers of manganese ore globally. Of the global annual production of 20 Mt, Eramet had an estimated production share of 37%, followed closely by South32 with 15%.

South32 Limited (ASX: S32, market cap AUD 16.42 B as of 06 Dec 2024 ): Headquartered in Perth, Australia, S32 is a multinational Australian firm (a BHP subsidiary) and one of the world’s major manganese producers.

It operates the GEMCO mine on Groote Eylandt in Australia's Northern Territory and the Mamatwan and Wessels mines in South Africa's Kalahari Basin. In the fiscal year 2024, S32 produced 2,175 k Wmt of manganese ore, which represents a significant reduction compared to the previous fiscal year 2023 (5,653 k Wmt), when production was double this amount, which was primarily due to the impact of Tropical Cyclone Megan in March 2024. The cyclone caused extensive flooding at the Groote Eylandt Mining Company (GEMCO) operations in Australia's Northern Territory, leading to a temporary suspension of mining activities.

Source: South32 Limited annual report 2023

In contrast, S32’s South African manganese operations experienced a 12% increase in output during the same quarter, attributed to strong mining performance. However, this increase was insufficient to offset the substantial decline in Australian operations.

The company has been implementing an operational recovery plan, including substantial dewatering efforts, and remains on track to resume ore production to over 5,000 k Wmt (around 5 Mt ) from the primary concentrator next year.

Eramet (EPA: ERA, market cap EUR 1.40 B as of 06 Dec 2024 ): A French multinational mining and metallurgy company, ERA operates the Moanda mine in Gabon through its subsidiary, Compagnie minière de l'Ogooué (COMILOG). This mine is one of the world's largest high-grade manganese deposits. Its products incorporate high-grade manganese alloys, manganese ore, and manganese chemistry, including agrochemicals, recycling, batteries, and electronics. ERA is the largest producer of high-grade manganese ore and refined manganese alloys in the world. It owns 25% of the world’s manganese reserves and produced 7.4 Mt of ore in 2023.

Source: Eramet official website

Anglo American plc (LSE: AAL, market cap GPB 30.40 B as of 06 Dec 2024 ): AAL is a British multinational mining company with headquarters in London, England. In Manganese, AAL has a 40% shareholding in the Samancor joint venture (managed by South32, which holds 60%). The manganese operations are located in South Africa and Australia, producing ore products for the steel industry. In fiscal year 2023, AAL produced 3.7 Mt of manganese ore.

Source: Anglo American annual report 2023

MOIL Limited (NS: MOIL, market cap INR 71.48 B as of 06 Dec 2024 ): Formerly known as Manganese Ore (India) Limited, MOIL is a miniratna state-owned manganese-ore mining company headquartered in Nagpur, India. MOIL is India's largest manganese ore producer with a market share of 50%, operating 11 mines across Maharashtra and Madhya Pradesh. MOIL achieved manganese ore production of 1.75 Mt in the fiscal year 2023, up 34.6% YoY.

Source: Steelorbis

Who needs manganese?

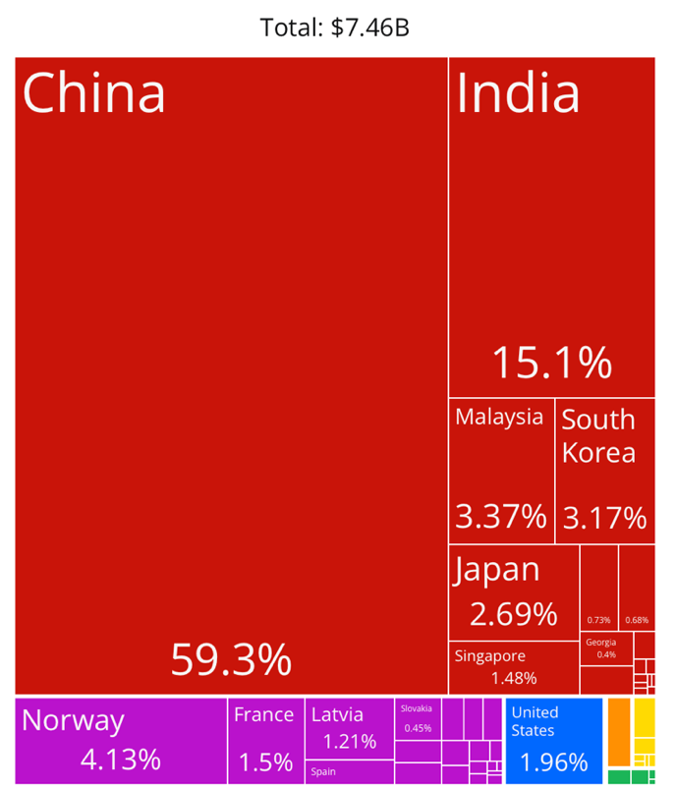

In 2022, the leading importers of manganese ore were China, accounting for USD 4.43 B (60% of total imports), followed by India at USD 1.13 B, Norway at USD 308 M, Malaysia at USD 251 M, and South Korea at USD 237 M.

China and India rank as the top six producers of manganese worldwide, with respective productions of 740 and 720 kt in 2023. Despite their significant output, they are also the largest importers of manganese, highlighting their substantial consumption levels. This high demand is primarily driven by their massive steel industries, which require considerable quantities of manganese.

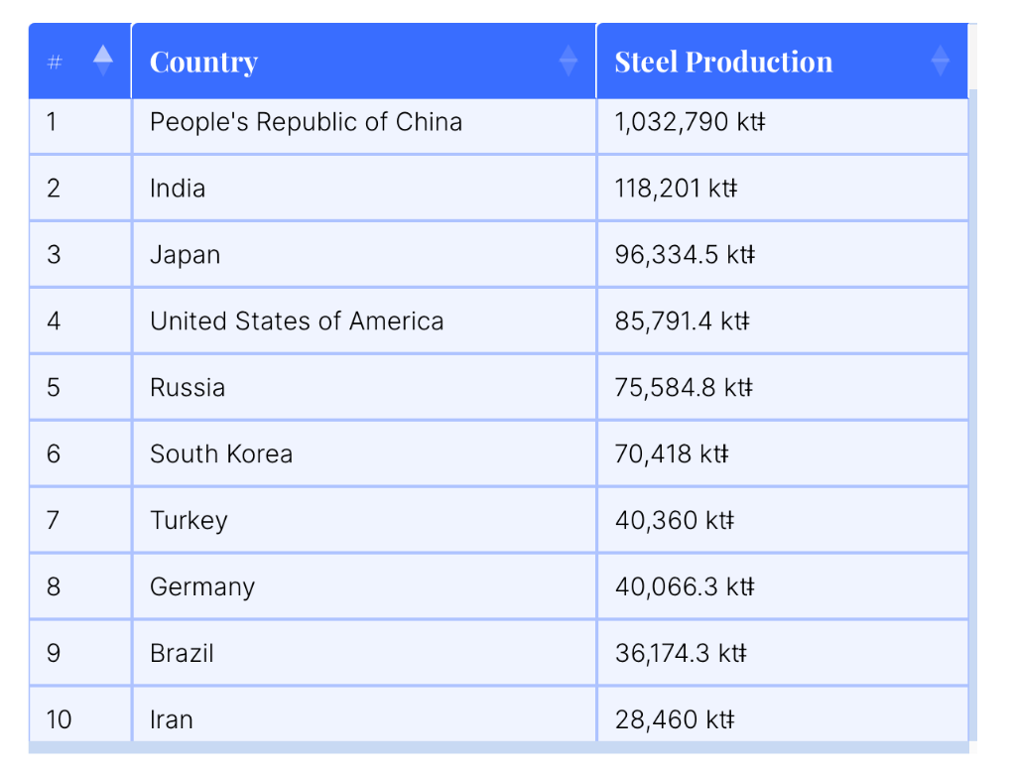

In 2023, China and India were the two largest steel-producing countries globally, with China's production being ten times that of India. Notably, China's steel production accounts for over 50% of the world's total output.

Consumption by industry

Steel as the dominated industry

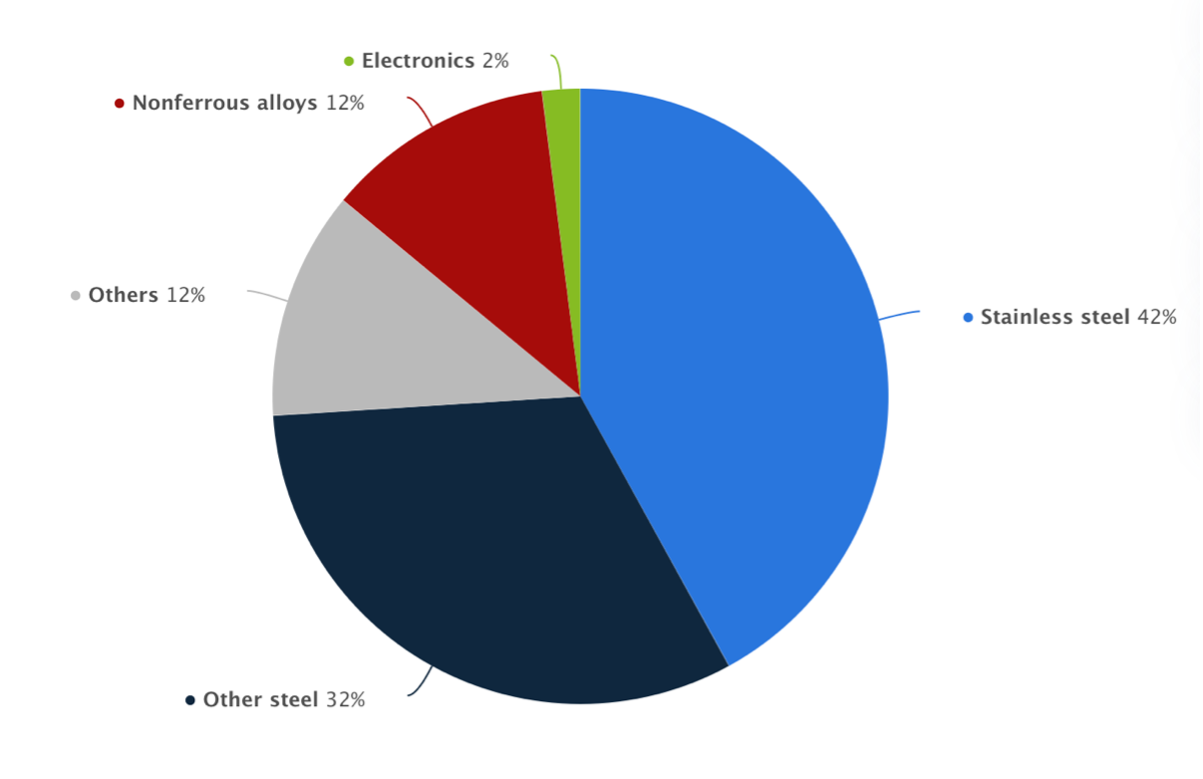

In 2023, stainless steel accounted for the world's largest consumption share of manganese, at 42 % of the global manganese consumption volume. Other steels accounted for the second-largest consumption share of manganese globally that year, at 32 %.

Renewable energy as a rapidly growing industry

Manganese is also employed in the renewable energy industry, including wind and solar power, as well as in rechargeable batteries of EVs. The adoption of manganese-rich battery chemistries will increase demand for manganese and raise supply concerns for battery-grade manganese. With the vigorous development of new energy, especially EVs, the application of manganese in electronics has been increased to 2% in 2023.

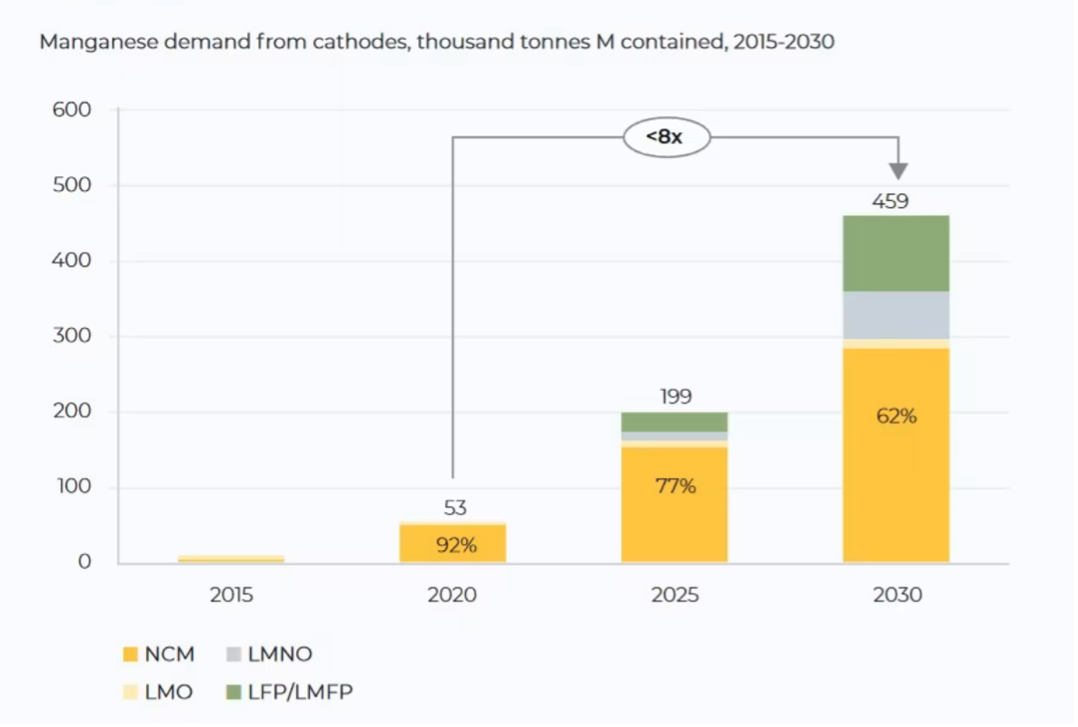

Although the application in it is rather small compared to the steel industry, the surging demand for manganese in energy batteries deserves increasing attention. Demand for manganese in batteries is set to grow over eight-fold (>8x) this decade, due to new battery chemistries and rising EV sales, according to Benchmark’s Manganese Sulphate Market Outlook.

In 2023, General Motors, made significant investments underscoring the growing importance of manganese in the future of energy storage.

The company invested USD 85 M in Element25 Limited (ASX: E25, market cap AUD 57.16 M as of 06 Dec 2024 ), a mining firm headquartered in Osborne Park, Australia, with a 100% interest in the Butcherbird manganese project in Western Australia. This investment aims to support the development of a manganese refinery in Louisiana. Additionally, General Motors led a USD 60 M Series B financing round for Mitra Chem, a Silicon Valley-based company focused on developing lithium manganese iron phosphate (LMFP) cathodes for next-generation batteries. These strategic moves highlight the increasing focus on manganese as a critical material in advancing battery technology.

Manganese market size

The Manganese Market size is estimated at 23.24 Mt in 2024 and is expected to reach 28.10 Mt by 2029, growing at a CAGR of 3.87% during the forecast period (2024-2029).

Source: Modor intelligence

Recovery of the construction industry

During the pandemic in 2020, construction activities were temporarily halted due to government-imposed lockdowns, leading to a decline in steel demand from the construction sector. However, the construction industry, after experiencing significant disruptions, is now showing signs of recovery, which is anticipated to drive increased demand in the coming years.

Expanding EVs sector

The rising demand for manganese in lithium-ion battery production, driven by the growing EV market, is also anticipated to fuel market growth.

Asia-Pacific as the fastest-growing region

The Asia-Pacific region is anticipated to dominate the manganese market and is projected to experience the highest compound annual growth rate (CAGR) which is largely driven by China's favourable environment for EV production, alongside the fact that both China and India are the largest steel-producing countries in the world. Additionally, the supply chain for high-purity manganese sulphate (HPMSM) production is dominated by China, which currently accounts for 96% of global supply.

Source: Benchmark’s source

Historical price of manganese

The price of manganese is very cyclical. It peaked respectively in 2017, 2020, and 2024.

Manganese prices exhibited a steady decline starting in 2014, reaching a significant low in 2016, which was mainly caused by the decline in global steel production, particularly in China, and the increased mining activity, especially in major producing countries like South Africa and Gabon.

The price surged dramatically after hitting a low in 2016, reaching a peak of over CNY 50/t (USD 6.89/t) during the period, which is due to the supply adjustments from manganese mining companies by scaling back production, creating a temporary supply shortage that pushed prices upward. The Chinese government’s economic stimulus in 2016 also revived the demand for steel and manganese, leading to a price surge.

From 2017 onward, the price stabilized at around CNY 40/t (USD 5.51/t), similar to levels seen before 2014. After reaching a peak in early 2020, the price of manganese declined and has remained at a lower level of approximately CNY 35/t (USD 4.82/t) as of March 2024. due to the economic slowdown and reduced industrial activities, particularly in China. In 2024, the price was close to CNY 40/t (USD 5. 51/t) before declining to the current stabilized level of CNY 30/t (USD 4.13/t).

As a cyclical commodity, the key price drivers of manganese include the demand of the steel industry where up to 90% of manganese application remains; development and growth of the EV industry where high-purity manganese are demanded for lithium-ion batteries; supply constraints including geopolitical issues, environmental regulations, and declining ore quality that can tighten supply; and China's role, as the largest consumer of manganese, China's steel and battery industries continue to exert significant influence on global prices.

The rest of this article is reserved for signed-in users.

Sign in or create your free account to read the full article.

Comments (0)

Sign in or create a free account to leave a comment.