High Costs and Geopolitical Turmoil Shake Investor Confidence in some Gold Miners

By Laurent MAUREL.

A seasoned investor and financial analyst with over 20 years of expertise in the metals and mining sector. As the founder of Recherche Bay, he provides market analysis and investment insights for Family Offices and Private Equity firms. His expertise includes asset valuation, financial due diligence, and portfolio strategy, with accreditation from the AMF.

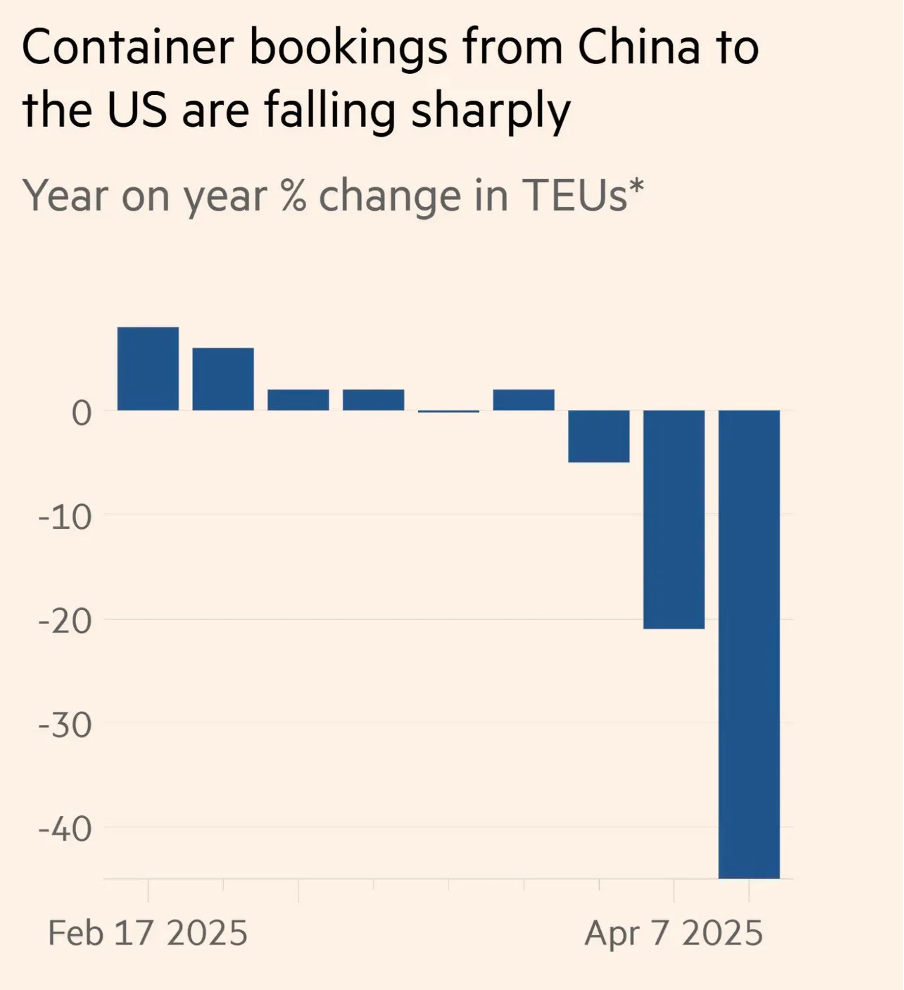

Between February and April 2025, container bookings between China and the United States dropped by over 40% year-over-year, signaling a sharp collapse in bilateral trade.

This decline is primarily the result of new U.S. protectionist measures, including higher tariffs. According to Freight Waves, imports from China fell by 64%, especially in the textile and apparel sectors. This trade disruption has led to massive order cancellations, an accumulation of unsold inventory in Chinese ports, and a global production overcapacity.

In the U.S., freight transport is slowing significantly, affecting logistics, the automotive industry, and threatening the banking sector exposed to truck leasing. Two scenarios are now emerging: a quick recovery through a new trade agreement, or the onset of a global recession spiral.

This situation has sparked division: some see it as a nationalist success, while others warn of rising risks of shortages and imported inflation. The debate reflects a growing political polarization, fueled by the contraction of U.S. GDP, the ballooning budget deficit, and a surge of retail investors into the stock market.

In this uncertain environment, gold continues to show resilience after a recent consolidation, buoyed by concerns over U.S. public debt.

The surge in gold prices is already causing major disruptions in Burkina Faso, both economically and politically. In this increasingly unstable context, it's essential to assess what could change in the short term for the mining industry in a jurisdiction that is becoming more complex and exposed. What new risks—and potential opportunities—might emerge from this rapidly evolving landscape?

The rest of this article is reserved for signed-in users.

Sign in or create your free account to read the full article.

Comments (0)

Sign in or create a free account to leave a comment.